We use the internet for shopping more frequently than ever in this mobile-first era. We can explain it by pointing out that comparing products from various online sellers is incredibly simple, and we can do so from the comfort of our sofa in most cases. Because of this, we frequently purchase through online marketplaces that link different suppliers of goods and services with prospective customers.

Customers are much easier to find for eCommerce businesses, and customers can easily find online retailers or service providers with the best reviews, reducing the chance of being duped into a bad deal.

Marketplace Business Model

There are two primary ways that businesses conduct themselves in this new world of centralized sales.

Marketplaces serve as final sellers, adding their own markup to vendor pricing, or as brokers, charging providers a commission for their services.

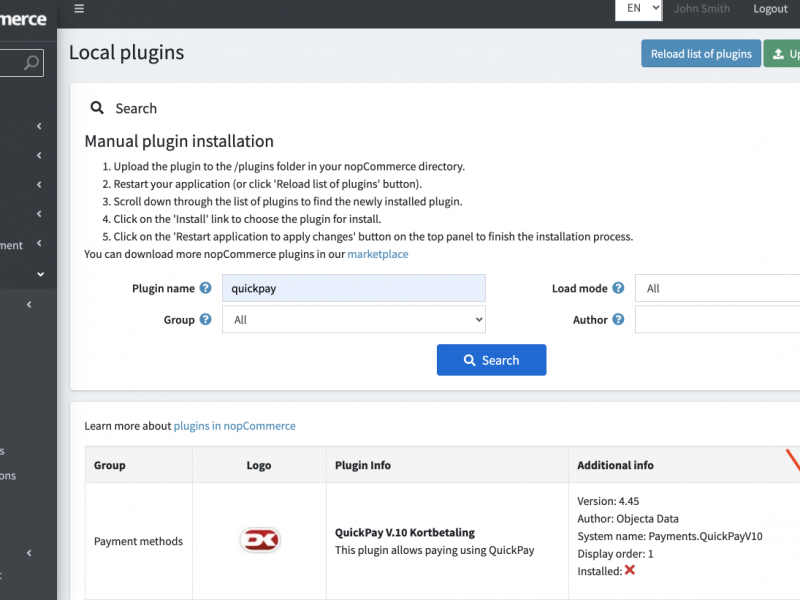

The marketplace functions as a marketing firm in a broker system. For each sale that is generated, it charges a commission to vendors. Payments are handled through a third-party payment processor or directly between buyers and sellers.

In the majority of countries, this system prevents the marketplace from acting as an intermediary and processing payments directly unless it obtains the necessary finance business license. Therefore, a third-party payment processor is needed in order to process payments through the platform.

In this case, as the marketplace only serves as a sales platform, liability for subpar goods can be transferred to the actual sellers.

Distributor

In a distribution role, the market place essentially purchases products or services from its suppliers and resells them to customers at a profit.

The most conventional business model is this one. In this case, processing payments is straightforward and can be handled by the platform itself. Every sale can be regarded as revenue, and every purchase made from sellers can be subtracted from marketplace income. Since all operations go through their books, companies using this model should theoretically be able to generate much higher revenues.

It’s also important to remember that, because it serves as a distributor, an online marketplace bears full liability for any defective goods.

Most Popular Payment Methods

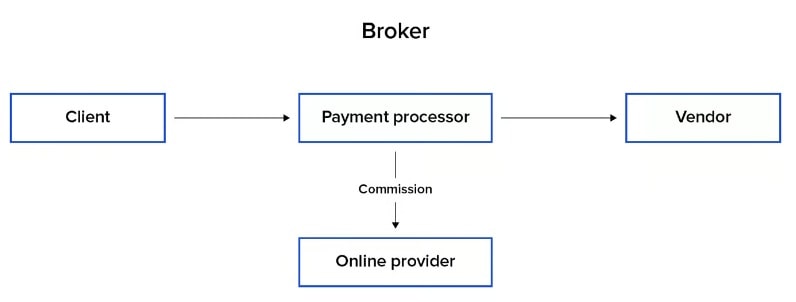

Different payment providers and methods may be used depending on the nation. Let’s review some of the potential payment processors based on a marketplace business model in order to simplify the situation as it stands.

Overview of Payment Processors

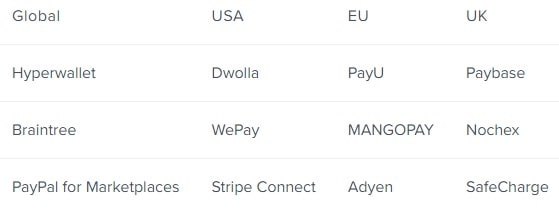

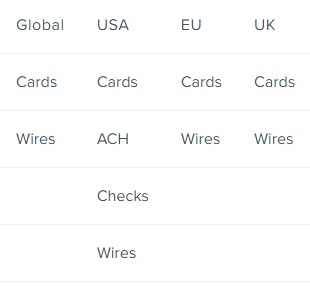

In the broker model, specific payment processors include:

Selected pay-in methods in the distributor model:

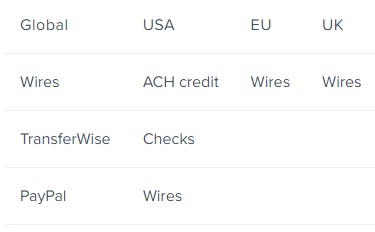

Certain methods of payout in the distributor model:

Global

Serving a worldwide clientele is never simple. Various nations have distinct cultures, languages, and legal systems in addition to using various currencies and local payment methods.

Certain providers attempt to balance these discrepancies and possible roadblocks.

Broker

Hyperwallet

Several of the biggest online brands use Hyperwallet, an enterprise payout solution. Large, well-established eCommerce businesses are a fantastic fit for it.

Braintree Marketplace

Braintree offers marketplace companies a scalable payment option. It can assist you in developing a marketplace that serves North America, Europe, and Oceania in addition to supporting all of the major markets.

Paypal

Without a doubt, the most widely used payment platform worldwide is PayPal. It doesn’t require much introduction, having grown on the success of eBay. You can quickly create an account, the API is simple to use, and it is supported in practically every country.

Distributor

Pay-in Methods

Wires

Across the globe, bank wire transfers via the SWIFT network are the most dependable option. Sadly, it’s frequently the priciest method of sending money as well.

TransferWise

TransferWise enables you to establish international accounts. It allows you to send and receive local payments in a lot of different nations. Local transfers frequently have minimal fees, and currency conversion is a simple process.

Stripe

Debit and credit card processing services are offered by Stripe in all major nations. In the US, it also permits the processing of ACH debit payments. It enables you to rapidly register and begin working on your application.

Payout Methods

Wires

Once more, using international SWIFT wires is the simplest and most convenient choice. When choosing whether or not to use this method, the cost of a transfer will be taken into consideration.

TransferWise

You can pay your providers in nearly every nation by using TransferWise. It lets you use multiple currencies and is reasonably priced.

Paypal

The most widely used payment method in the majority of the world’s nations is PayPal. They may end up being fairly costly over time because they charge a fee for every transaction.

USA

Broker

Dwolla

With Dwolla, sending and receiving ACH payments is simple and requires only bank accounts. It offers numerous application possibilities and is developer-friendly.

WePay

The robust platform known as WePay is supported by Chase Bank. It is ideal for a platform that caters only to US users because it is made for broker marketplaces.

Stripe Connect

Specifically designed for broker marketplaces, Stripe Connect is an incredibly developer-friendly solution. It is specifically made to fit the needs of the US market.

Distributor

Pay-in Methods

Wires, Ach Credit, Checks

The simplest method of taking payments is to simply accept bank-to-bank transfers. Accessible payment options include wire transfers, ACH credit, and paper checks. Even with availability, processing time and expense could be a major problem.

Authorize.Net

You can accept payments using credit, debit, and ACH debits (eChecks) with Authorize.Net. It is a reputable Visa company.

Square

Square provides a wide range of options for online and in-store retailers. It does provide developers with a good API, but it appears that they only support credit and debit card payments.

Payout Methods

Ach Credit Transfers

ACH credit transfers, which are offered by banks that are a part of Nacha and can be very cost-effective, are the simplest way to send payouts at scale. A maximum of $25,000 can be paid with ACH each transaction.

This payment option is provided by Chase Bank as an extra.

Wells Fargo provides Direct Pay for it.

Wires

One of the simplest methods for sending money electronically is this one. Unfortunately, sending and receiving it from US banks come with hefty fees. They ought to only be utilized when transferring substantial sums of money because of this.

Checks

In the US, one of the easiest ways to transfer money is via checks. Regretfully, compared to other methods, it is more troublesome and slower.

European Union

Broker

Payu

PayU is a reputable provider of payments for online marketplaces. It is a safe option and is utilized by some of the largest local eCommerce platforms in Europe.

MangoPay

All EU nations can use the marketplace payment processor MANGOPAY. It appears to be well suited to the requirements of a market platform for the entire EU.

Adyen

A lesser-known supplier of payment processors that works with all EU nations is Adyen. An additional benefit is that it accepts payments through local methods.

Distributor

Pay-in Methods

Wires

Both inside and outside of the Eurozone, wires are incredibly common. This is due to the fact that they are typically free to send, operate quickly, and typically provide same-day transfers. The SEPA network is used to send payments in euros.

Paymill

You can begin taking online credit card payments with PAYMILL. The main emphasis is on euro payments.

Paylane

You can use PayLane as a gateway to make bank-to-bank payments in addition to online card payments. It is especially well-suited to the Polish market’s requirements.

Payout methods

Wires

For payouts within the European Union, all you need is a SEPA wire transfer. Even for international transfers, they are frequently free, quick, and often delivered the same day.

UK

Broker

Paybase

Paybase is a marketplace payment provider situated in London. They give unique sort codes and account numbers for eMoney accounts.

Nochex

Nochex is a marketplace platform enterprise solution. They offer bespoke solutions to clients in the United Kingdom.

Safecharge

SafeCharge offers payment options for marketplaces situated in the United Kingdom. They provide developers with good API documentation.

Distributor

Pay-in Methods

Wires

Sending money in the UK can be done quickly and for free using bank transfers. They are simple to use and available to all. It’s the most practical way to take big payments in a distributor model.

Sage Pay

Sage Pay is a payment provider with a UK focus. It works with online and brick-and-mortar retailers. Regretfully, the public cannot access their developer guide.

Worldpay

You can make online credit card payments with Worldpay. They offer developer guides that are simple to follow and are well-suited to the UK market.

Payout Methods

Wires

Wire transfers are really the only method required for payouts made within the United Kingdom. They are quick, simple, and cost-free. You can make payments to anybody in the UK with them.

Potential Risks

Prior to beginning business with a payment processor partner, you should research their reputation. There are awful reviews even for some of the largest providers.

PayPal is a prime example; it has a reputation for abruptly suspending user accounts and freezing funds for up to half a year.

Developer-friendly and possessing some of the best technology on the market, Stripe is a well-known company. Regretfully, they also have a history of abruptly blocking accounts in the middle of the night.

For these reasons, it might be a good idea to implement payments in a generic way, making it simple to switch providers in the unlikely event that you are shut down over night.

The chargeback process is something you should be aware of when processing card payments. Customers may occasionally be unhappy with the service or goods or fail to notice a card transaction. They may get in touch with the seller in these situations and attempt to settle the dispute.

They may dispute this card transaction with their bank if the issue isn’t resolved. The funds for this transaction are deducted from the seller’s account if the financial institution determines that the customer was correct. Because they bear the responsibility for all transactions that are reimbursed, payment processor companies are not fond of chargeback disputes. As a result, they fire high-risk retailers quickly.

Chargebacks for unauthorized transactions or instances where the amount debited exceeds the authorized amount are another risk associated with ACH payments. Here is where you can learn more.

When wire transfers are accepted, there is no such risk. Therefore, when taking large payments, wire transfers might be the safest option.

Local Is Often Better

It could be preferable to deal with local suppliers due to potential issues that arise when collaborating with payment processor companies. Local businesses frequently provide greater cooperation, simpler communication, and greater trust in you than do overseas providers.

In addition, it is always simpler to file a lawsuit against a local business than a foreign one in the event of major issues or losing access to your funds.

Alternative Crypto Method – USD Coin

Although they are still not a popular option for online payments, cryptocurrencies are growing in popularity. For daily financial transactions, the majority of cryptocurrencies are unsuitable due to significant price fluctuations and volatility concerns.

Still, researching stable coins might be worthwhile. The USD Coin (USDC) is one such instance. It is a coin powered by Ethereum that can be redeemed 1:1 for US dollars.

Its obvious benefit of being able to be sent fast and affordably to any location in the world makes it an ideal substitute for the sluggish and frequently costly international transfers.

Additionally, using Coinbase Commerce to begin accepting payments in USDC is a very simple process.

Cryptocurrencies have significant drawbacks because of the persistent perception that they are only used for illicit activities. When converting them into fiat money in bigger quantities, that might lead to more scrutiny and inquiries. Furthermore, it is well known that US traditional banks will terminate the accounts of customers who utilize cryptocurrencies.

As of this writing, the standard transaction cost on the Ethereum network is approximately $0.007, and it settles in less than five minutes, according to the now-retired ETH Gas Station web app. These parameters are highly appealing. One may wonder if microtransactions would work well with cryptocurrencies. Regretfully, transfers appear to be a risky option due to their variable time and cost. An additional issue may be the time and expense required to initially obtain cryptocurrency, particularly in some regions of the world.

These factors suggest that a different cryptocurrency strategy might not be quite ready for prime time.

Simple Marketplace Payment Implementation

Now that we have covered all the groundwork, let’s build a real marketplace for purposes of demonstration!

It will follow the distributor business model and be a straightforward, general eCommerce marketplace. Although we will modify it for the US market, it could also be readily adjusted to function in other nations.

We will take the following forms of payment:

- ACH credit transfers

- Wire transfers

- Credit and debit cards using Stripe

Because Stripe is available in many countries, has an excellent developer guide, and only takes a few minutes to create an account, it was selected as the payment processor. As such, a large number of potential users can readily access their services.

We’ll just use ACH payments as our payout method, which banks and TransferWise can readily provide, as was previously mentioned.

On GitHub, the marketplace implementation is accessible to the general public.

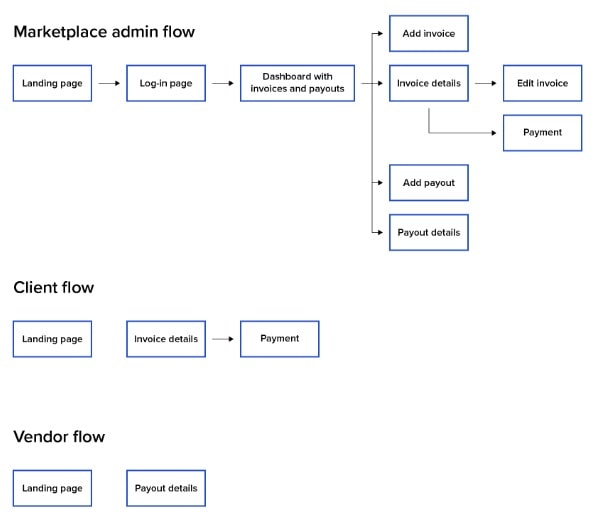

Marketplace Design

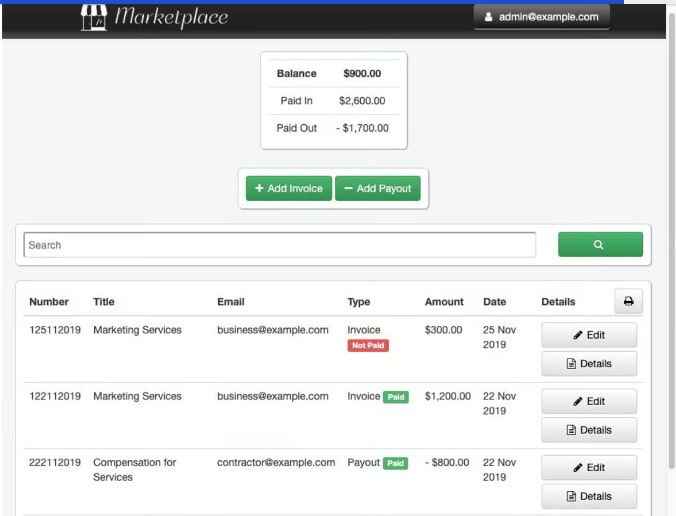

Admin users with the ability to issue invoices and payouts are supported by the marketplace. Additionally, they have access to the dashboard, where they can view and search the list of transactions. Usually, a financial summary of all transactions appears at the top of the dashboard.

In addition to viewing and paying invoices, guest users can access the landing page and view payouts.

The user is prompted to create an administrator account upon activating the application. Subsequently, they must configure bank account information and Stripe API keys in order to accept wire transfers and ACH credits.

We are now ready to begin issuing transactions!

From the dashboard, the administrator can quickly generate payouts and invoices. An email address will be provided with information about them. As an alternative, you can manually share an invoice or payout URL with the recipient.

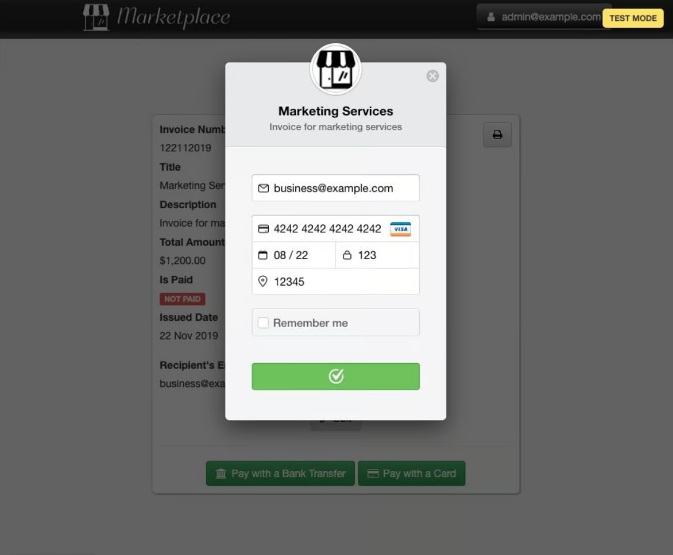

Invoices can be conveniently paid with a debit or credit card by customers. In the unlikely event that a stolen card is used, it protects sellers from chargebacks by supporting 3D secure payments.

Wherever it makes sense to use a distributor business model, this straightforward marketplace can be used. Here are a few instances of these companies:

- Accounting services

- Marketing services

- Construction services

- Cleaning services

- Various B2B businesses

- Car rentals

- House rentals

- Wholesalers

It can significantly enhance the lives of small business owners despite its straightforward design.

Marketplace Walkthrough

DASHBOARD

A table containing a financial summary and a list of all transactions are visible on the main page. The user can edit the current payouts and invoices as well as add new ones from this page.

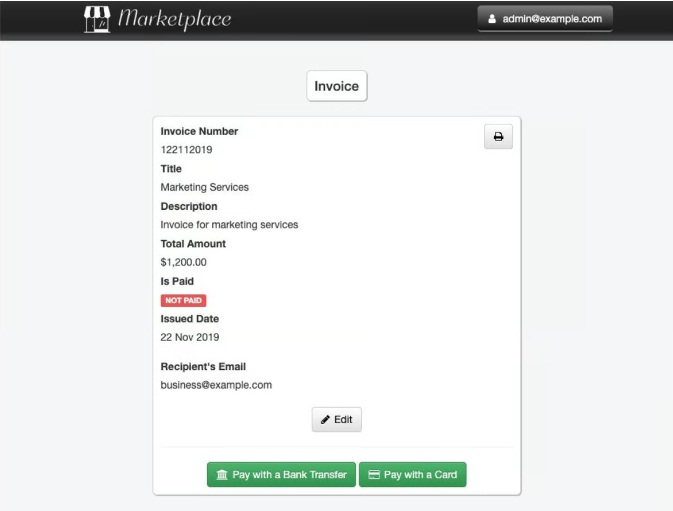

UNPAID INVOICE

The client is given the choice to pay via a bank transfer or a credit card when a new unpaid invoice is generated.

CARD PAYMENT

Paying the invoice with a credit card is a practical option. After choosing this option, a dialog box asking the user to confirm the transaction and provide a few details appears.

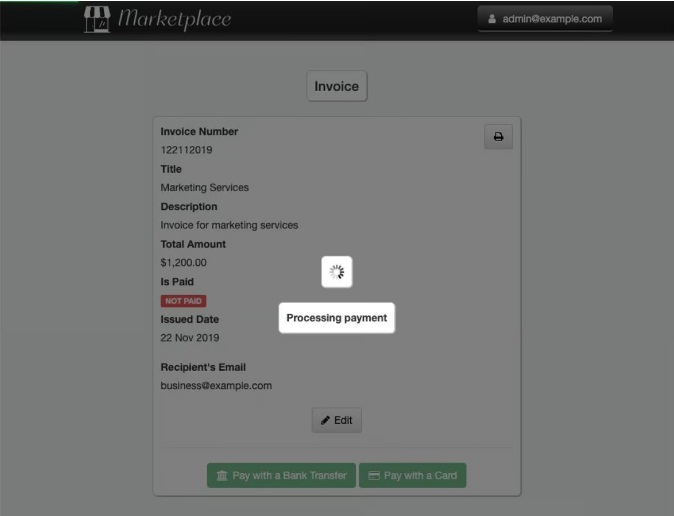

PROCESSING CARD PAYMENTS

We must wait for the card payment to be processed by the payment processor after it has been verified. The invoice page is blocked with a spinner loader during this process to show that everything is proceeding as planned and that the transaction will settle shortly.

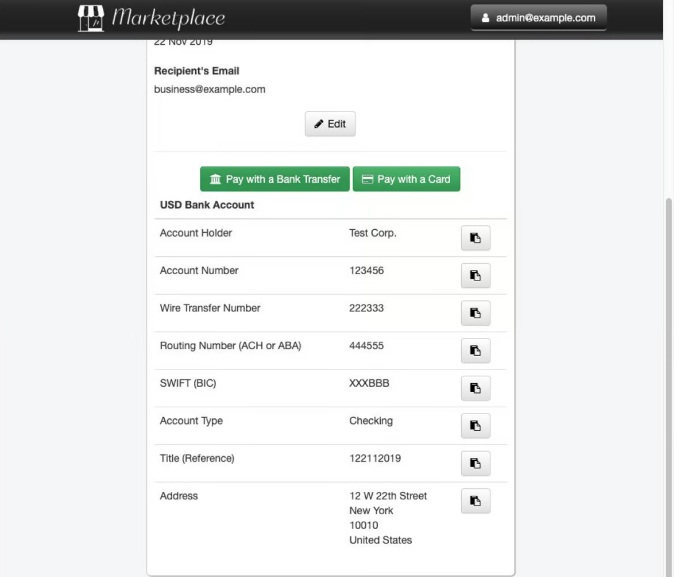

PAYMENT VIA BANK TRANSFER

The client will be prompted for bank account details if they choose to pay by bank transfer, and this information should be adequate to initiate an ACH or wire transfer. Every row has a button on the right that makes copying it simple.

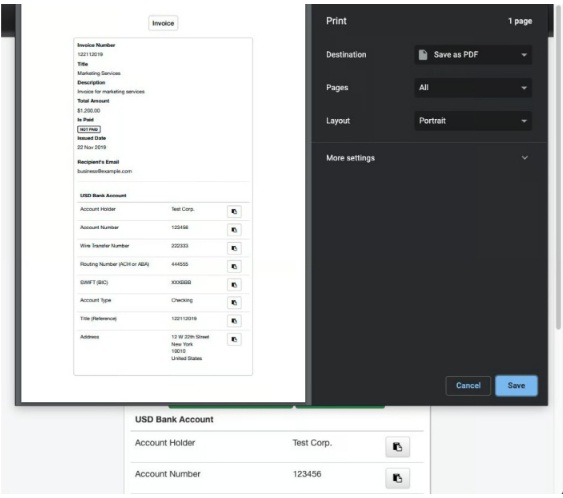

INVOICE PRINTOUT

The print button located in the upper right corner can be used to print invoices. It can be helpful to carry out a bank transfer in a branch or for accounting purposes.

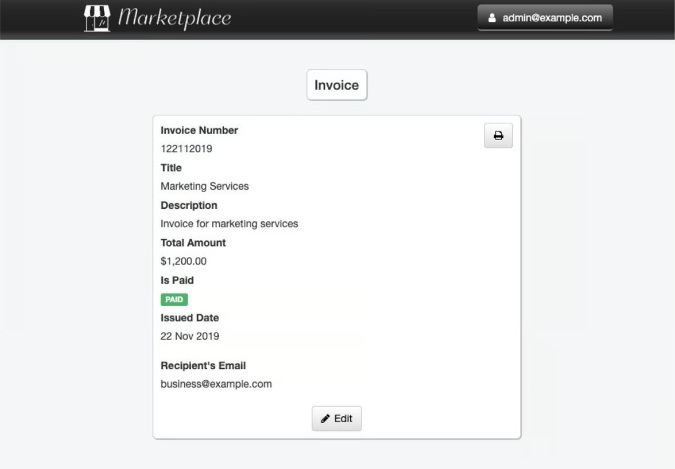

PAID INVOICE

Once an invoice is paid, the payment option is removed to avoid duplicate payments. A clear green status label is displayed.

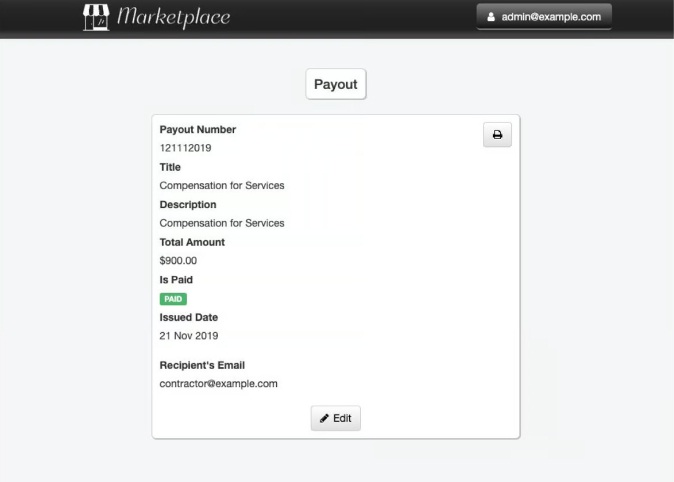

PAID PAYOUT

The payout design is similar to the invoice. The status indicator and all the data are clearly visible.

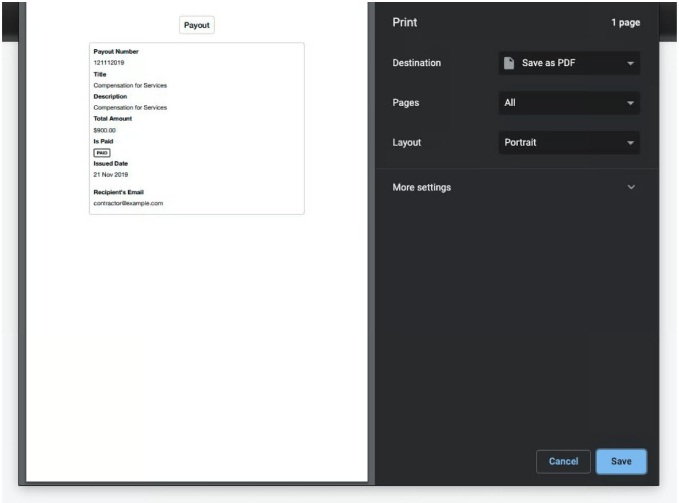

PAYOUT PRINTOUT

Using the print button located in the upper right corner, payouts can also be conveniently printed. Printouts can be utilized for record-keeping.

The Code

TypeScript is the scalable alternative to JavaScript that was used to create this web application. Both the server-side and the client-side use this language. This application can be used in both development and production modes. In order to utilize as many cores as possible, it will launch multiple threads when in production.

MongoDB is used by it as a database. It’s a widely used NoSQL document storage solution.

For UI management, it makes use of SCSS and the Bootstrap library.

Summary

The conventional online marketplace business model is highly well-liked since it offers clients a quick and secure purchasing experience. We have a choice between the two most widely used models: the distributor system and the broker model.

You can choose the payment processor that best meets your needs based on the nation in which you intend to conduct business. Sometimes all you need is a bank account, but if your target market is foreign or worldwide, you will require additional payment options.

You can start using online marketplaces by using the basic implementation that this article explains. It is my hope that you will find it helpful in expanding your business.

Yury Sobolev is Full Stack Software Developer by passion and profession working on Microsoft ASP.NET Core. Also he has hands-on experience on working with Angular, Backbone, React, ASP.NET Core Web API, Restful Web Services, WCF, SQL Server.