One of the many options for making online payments is through a payment gateway, which is a technology for handling financial transactions. This technique is used by everyone, whether they are doing business or not, to save time and energy.Websites can use a variety of payment gateways. Additionally, a multi-currency payment gateway is offered for trading currencies like forex and cryptocurrencies. The global market for payment gateways was estimated to be worth $22.09 billion in 2021, and the Grand View Report predicts that it will grow at a CAGR of 22.1% from 2022 to 2030.

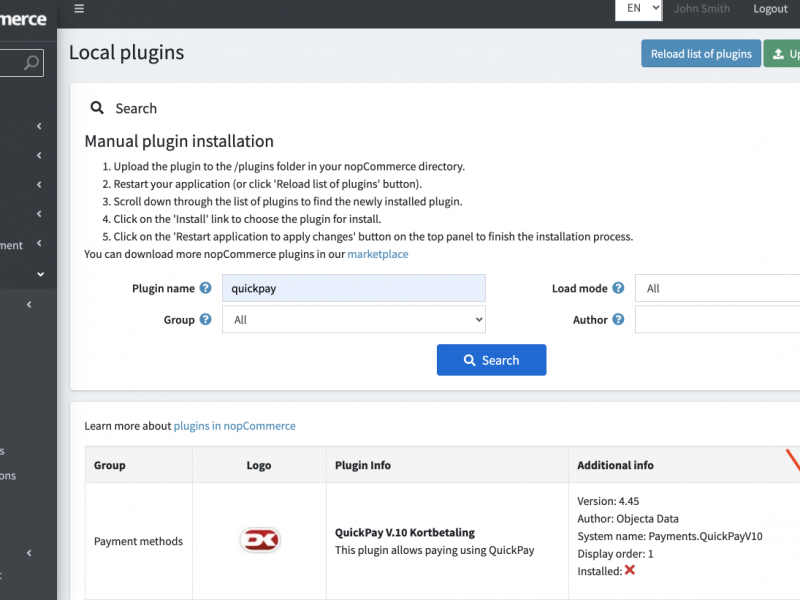

How does the payment gateway operate?

- On a merchant’s website, customers make purchases of goods and services.Forex VPS.

- Customers are redirected from the merchant’s website to the secure website of the payment gateway.

- The buyer fills out the payment gateway’s website with their credit card number, expiration date, and security code.

- The payment gateway checks for fraud and validates the customer’s payment information.

- The payment gateway notifies the customer’s bank to request authorization for the payment if the payment information is accurate and no fraud is found.

- The payment gateway receives a response from the customer’s bank stating whether the payment has been approved.

- If the transaction is approved, the payment gateway notifies the merchant’s website that the transaction was successful.

- Order processing is completed on the merchant’s website, and the customer receives a confirmation of their purchase.

How to Setup Payment Gateway on Your Site?

The following steps must be taken in order to integrate a payment gateway with your website:

- Make an account with the payment gateway provider of your choice.PayPal, Stripe, and Square are a few well-known service providers.

- Connect your website to the payment gateway API.

- This usually entails adding some code to the checkout page of the website to handle the processing of payment information.

- To make sure the integration is operating properly, test it.

- Make sure your website is PCI-compliant. To prevent security lapses and credit card data theft, it is essential to take this action.

- Deploy the changes to your live website.

- Go live with the payment gateway.

And after taking these actions, you will have added a payment gateway to the website.

Note:-

- Depending on the particular payment gateway provider you select and the programming language or framework you use to build your website, the steps may change.

- Consult the documentation and support materials offered by the payment gateway provider.

Why We Need Payment Gateway?

Merchants and customers use a payment gateway for cardless and cashless financial transactions. Whether making an online or offline purchase, a customer transfers funds to the merchant’s account using a payment gateway like Paytm, PayPal, BlueSnap, etc.

The following are the main benefits of utilizing a payment gateway:

- Payment gateways streamline and speed up your work, saving you time.

- Customer and business transactions are secure.

- Whether you create an online store, subscription website, or website for online education, you need a payment gateway for simple payment conversion and a simple procedure.

5 Best Payment Gateways Based on Our Recommendation

1. Paypal

PayPal is a financial services provider that makes it possible for individuals and organizations to send and receive payments online. One of the biggest online payment gateways in the world, it was established in 1998 and is now accessible in more than 200 nations and supports more than 25 different currencies.Users can send and receive payments through PayPal as well as send money to other users. PayPal also provides additional financial services like credit and debit cards and mobile banking.

Pros of PayPal

- Easy to use with specific features.

- It provides high security and keeps your money safe.

- It keeps your bank information and other data safe.

- Let’s send money to family and friends without any charges.

- PayPal provides Digital wallets to its users.

Cons of PayPal

- If you use PayPal for business transactions, there are fees on transactions.

- A fee of 1% of your transaction amount must be paid if you want instant access to your money; free bank transfers may take a few days.

- Another platform for processing payments that enables companies to accept payments online and through mobile apps is Stripe. Additionally, it enables businesses to process payments made with credit cards and other methods like ACH bank transfers, Apple Pay, Google Pay, and others. Because it provides a range of features like recurring billing, fraud protection, and the capacity to accept various payment types, Stripe is a well-liked option for companies of all sizes. Furthermore, Stripe supports over 135 different currencies.

2. Stripe

Another platform for processing payments that enables companies to accept payments online and through mobile apps is Stripe. Additionally, it enables businesses to process payments made with credit cards and other methods like ACH bank transfers, Apple Pay, Google Pay, and others. Because it provides a range of features like recurring billing, fraud protection, and the capacity to accept various payment types, Stripe is a well-liked option for companies of all sizes. Furthermore, Stripe supports over 135 different currencies.

Pros of Stripe

- Its features are easy to use and understand.

- Multiple support options and 24*7 service.

- Live chat support for complex issues.

Cons of Stripe

- Stripe is not as user-friendly as PayPal.

- Available in only a few countries.

- It takes too much time to access your money.

3. Skrill

Another well-known payment processor that provides a variety of online payment and money transfer services is Skrill. Since its debut in 2001, Skrill has grown to serve many prestigious corporations as clients. One of the most popular payment gateways in the UK, Skrill accepts more than 30 different currencies worldwide.

Pros of Skrill

- Users can transfer money by using an email address or phone number.

- Skrill is straightforward and fast to use.

- It is one digital wallet payment gateway awarded by many well-known companies.

- You can create an account in Skrill without any charges.

Cons of Skrill:

- Skrill’s verification process takes a little long time.

- It provides limited customer service.

4. Authorize.net

If your company has complicated payment requirements, Authorize.net is the best international payment gateway for your website. It is an electronic check payment system, and you can use the website or the Authorize.net virtual terminal to make payments from other bank accounts.

Visa owns Authorize.net, which offers flexibility to businesses while also providing necessary infrastructure and security. Additionally, Authorize.net makes your payment translation quick and secure.

More than 370,000 merchants use Authorize.net.

Pros of Authorize.net

- Transparent and fixed-rate pricing.

- Provides 24*7 customer support.

- No charges for early termination.

- Easy to use.

Cons of Authorize.net

- You have to pay a $25 monthly fee, even if you don’t use it.

- It doesn’t have a robust point-of-sale system for in-person transactions.

- Outdated user interface.

- They offer their service in just 3 locations – the UK, Australia, USA.

5. Square

The payment gateway that is frequently used for international money transfers is Square. It provides simple integration and a number of features, including inventory control and invoicing. Even some small businesses accept payments through Square.

Pros of Square

- No monthly or annual fees

- Account creation and verification are not time-consuming

- No hidden fees.

- Easy to manage payment disputes.

- Your payments are secure.

- Easy to use and user-friendly interface.

- Free swipe card reader

- No contract to use Square service for your business.

Cons of Square:

- Customer support is not good.

- Expensive add-on service.

- Predictable fixed-rate 2.6% + $0.10 per swipe, which can be increased for more significant business.

Conclusion

The ideal payment processor for your website will depend on your unique requirements and situation. Therefore, it is crucial to carefully weigh your options and select a payment gateway that satisfies the requirements of both your company and your clients.

Javier is Content Specialist and also .NET developer. He writes helpful guides and articles, assist with other marketing and .NET community work